FRAUD, BACKGROUND CHECKS

& COMPLIANCE INVESTIGATION

SEARCH TOOLS

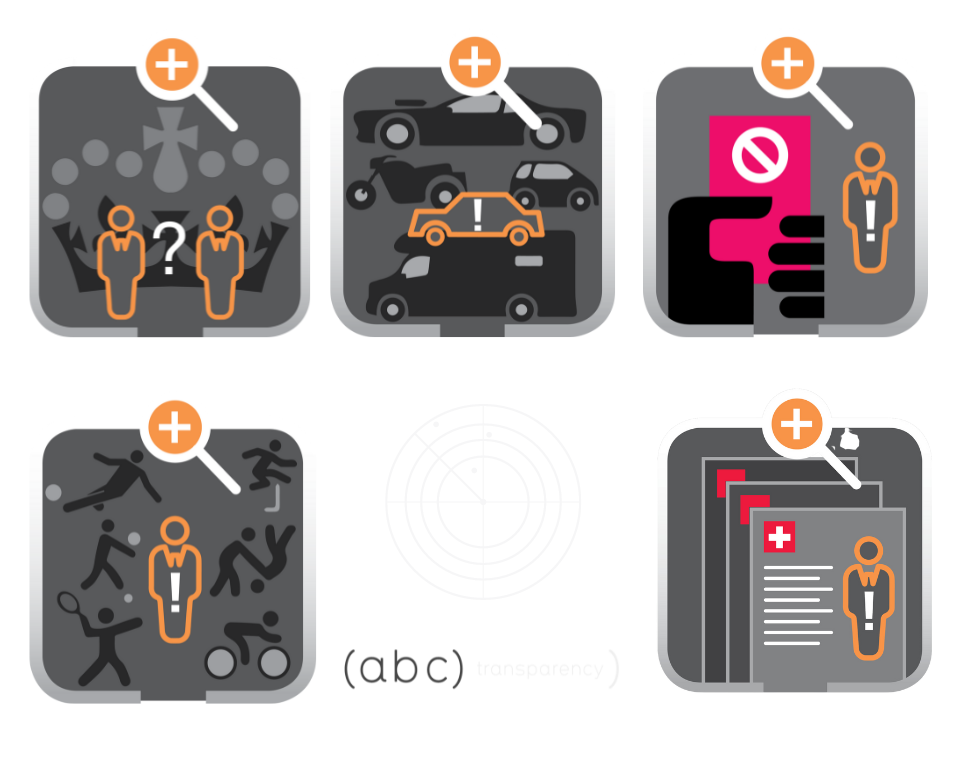

TURBOCHARGE YOUR COMPLIANCE AND FRAUD INVESTIGATION POTENTIAL!

Save time, make confident decisions, and safeguard your business with our advanced investigation research tools. Seamlessly assess third-party risks and related parties, conduct thorough fraud background checks, identify potential conflicts of interest, gain valuable insights from social media profiles, and perform comprehensive due diligence.

Whether you're in the finance, legal, or corporate sector, our tailored tools empower you to mitigate risks, ensure compliance, and protect your reputation. Take control of your investigations and unlock the power of precise data analysis, streamlined processes, and actionable intelligence. Enhance your due diligence, fortify your risk management, and gain a competitive edge with our industry-leading research tools.

(abc) search) provides support to fraud examiners, compliance officers, AML officers, investigative journalists, private detectives, and all other professionals who need to access reliable open source intelligence for their work. Our solution is intended for insurers, banks and corporations from other sectors, regulators, law firms and consultancies, as well as for media houses. It is primarily used for fighting frauds, fit & proper screenings, due diligence procedures and conflicts of interest management.

Explore All Of Our Fraud Search Tools!

Accelerate your due diligence tasks by searching in multiple sanctions lists from a single point.

Search for persons in the Companies House and the Insolvency Service registers and find connections between them!

SWISS REGISTRIES SEARCH

Search in all Swiss commercial registries for individuals from a single point!

WE PROTECT YOUR DATA AND SEARCH PRIVACY. PERIOD.

Once your search is finished, we delete the content permanently from our server. Our publicly-sourced data is all publicly available for your investigative research. We source only from publicly available websites. Every record is verifiable with a link!

FOR A LIMITED TIME: YOU CAN TEST OUR INVESTIGATION RESEARCH TOOLS WITH 100 FREE SEARCH CREDITS!

Share us on